October 2020 | Nº1

Our Thoughts

What we talk about

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press ReleaseMadrid, 25th May 2021Digital banking demands a holistic and resilient customer-focused approach to communication and operationsNew ways of interacting with customers can help improve the customer relationship and increase profitability Despite the name, ‘digital banking’ is still very much a business model for ‘real’ banking, and this means that digital innovations present both opportunities and challenges for reinventing financial services. As a result, such a

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press ReleaseMadrid, 25th May 2021Digital banking demands a holistic and resilient customer-focused approach to communication and operationsNew ways of interacting with customers can help improve the customer relationship and increase profitability Despite the name, ‘digital banking’ is still very much a business model for ‘real’ banking, and this means that digital innovations present both opportunities and challenges for reinventing financial services. As a result, such a business model demands a change in strategy: a comprehensive, holistic and resilient customer-focused approach that takes advantage of new ways

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press ReleaseMadrid, 25th May 2021Digital banking demands a holistic and resilient customer-focused approach to communication and operationsNew ways of interacting with customers can help improve the customer relationship and increase profitability Despite the name, ‘digital banking’ is still very much a business model for ‘real’ banking, and this means that digital innovations present both opportunities and challenges for reinventing financial services. As a result, such a

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press ReleaseMadrid, 25th May 2021Digital banking demands a holistic and resilient customer-focused approach to communication and operationsNew ways of interacting with customers can help improve the customer relationship and increase profitability Despite the name, ‘digital banking’ is still very much a business model for ‘real’ banking, and this means that digital innovations present both opportunities and challenges for reinventing financial services. As a result, such a business model demands a change in strategy: a comprehensive, holistic and resilient customer-focused approach that takes advantage of new ways

Previous Posts

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press ReleaseMadrid, 25th May 2021Digital banking

The customer lifecycle in a digital environment

The customer lifecycle in a digital environment Press ReleaseMadrid, 11th May 2021The digital customer lifecycle is no longer linear and

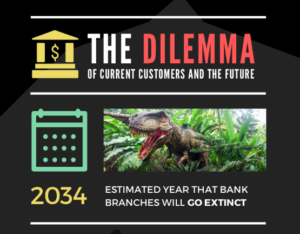

The dilemma for the banking industry: current customers and the future

The dilemma for the banking industry: current customers and the future GDS Modellica The banking system, or if you like,

Case Study

Request More Information

GDS Modellica S.L, C.I.F. B-84045723, inscrita en el Registro Mercantil de Madrid – Av Filipinas 1 bis, 28003 Madrid