In the interview on the program “Desayunos Capital” on Radio Intereconomía, Antonio García Rouco emphasized the arrival of conversational banking.

Intelligent conversational banking allows the creation of a close relationship with clients and the identification of their needs through algorithms that can reach the emotions or feelings of the users, with the aim of offering them customized services. These conversational banking functions are aimed at the end user in search of interaction between customers and financial institutions, through AI, in a natural way.

“In Spain, we are ahead compared to neighboring countries in this type of technology, where the main players in the sector have been doing so for years (although the Anglo-Saxon countries are ahead). In fact, we have banks that only and exclusively operate via mobile phones”, explained the General Manager of GDS Modellica.

García Rouco concluded that, in this type of service, security is a key point for financial services, and that banks take it very seriously as a result of the legislation in force and the application of intra-Community laws such as the PSD2.

Latest Articles

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press

26/05/2021

The customer lifecycle in a digital environment

The customer lifecycle in a digital environment Press ReleaseMadrid, 11th May 2021The digital customer lifecycle

10/05/2021

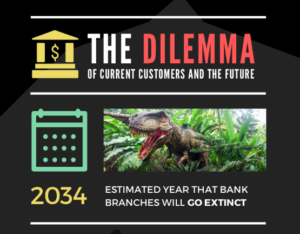

The dilemma for the banking industry: current customers and the future

The dilemma for the banking industry: current customers and the future GDS Modellica The banking

23/04/2021