A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

Press Release

Madrid, 25th May 2021

Digital banking demands a holistic and resilient customer-focused approach to communication and operations

New ways of interacting with customers can help improve the customer relationship and increase profitability

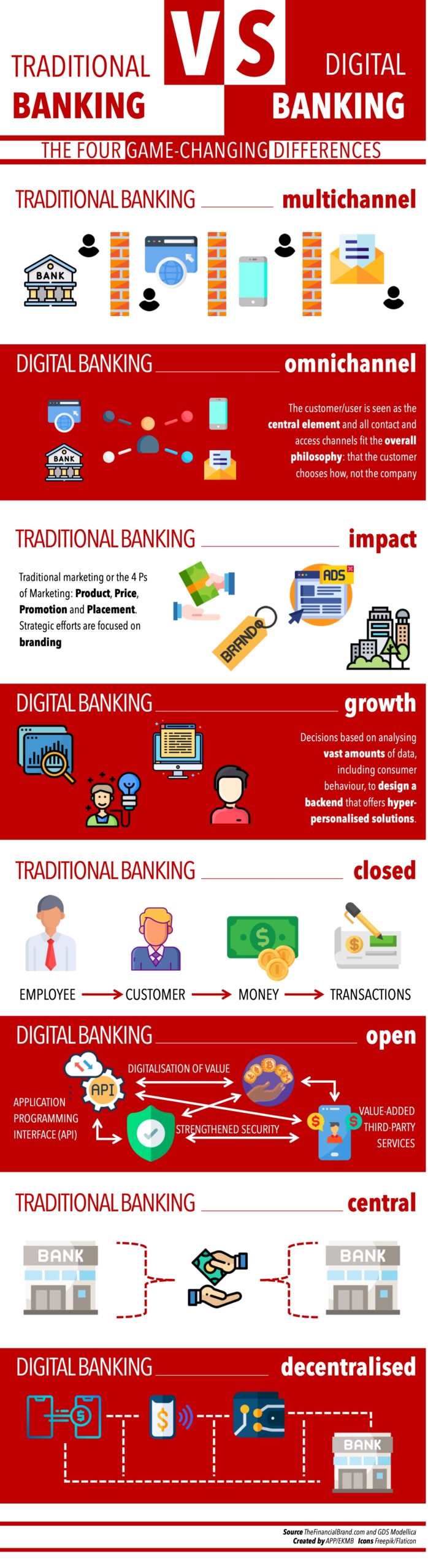

Despite the name, ‘digital banking’ is still very much a business model for ‘real’ banking, and this means that digital innovations present both opportunities and challenges for reinventing financial services. As a result, such a business model demands a change in strategy: a comprehensive, holistic and resilient customer-focused approach that takes advantage of new ways of communicating and operating.

Today, in the banking world, digital technology reigns supreme, and increasingly more customers are choosing to manage their finances online. Many people check their smartphones several times a day and customers are increasingly using banking apps to consult their balances, make payments and carry out other transactions. Furthermore, customers are more discerning when it comes to services and quality, seeking out better fees, special products, promotional offers and other extras. As a result, customers who have a good banking experience tend to be very loyal.

The ways that banks choose to interact with customers have also changed and service providers are now more concerned than ever with customer satisfaction, customer loyalty, profitability and establishing long-lasting relationships. According to GDS Modellica, financial organisations are now finding that they need to adopt a holistic approach to provide an improved customer experience and achieve better results. In particular, they are having to pay special attention to the following key points:

Clarity, transparency and simplicity in communication are vital.

Good communication with the customer relies on efficiency, speed and an omnichannel presence.

A customer good experience will lead to better and more efficient sales.

Business strategies should aim to bring together online and offline services and integrate digital systems.

Analysing and using customer data will help make transactions more efficient and address the customer in a personalised way to offer services that meet their exact needs.

With the additional help of artificial intelligence, digital banking is generating vast amounts of data that requires rapid, precise and robust analysis. This, in turn, will provide greater knowledge about customer habits and preferences, help gain and retain customers and have a positive impact on revenue. Furthermore, adopting the latest analytical models offers the chance to obtain richer data, and machine learning is capable of identifying complex, non-linear patterns from large data sets to generate more accurate risk models.

These days, banks generate so much data that they often lack the capabilities to effectively handle and analyse it all. As a result, they turn to companies like GDS Modellica to help them analyse macro-data, carry out predictive analysis and harness the power of other big data tools to help increase collections and protect themselves against fraud quickly and efficiently. For lenders, for example, it is absolutely vital to have a system that can analyse data and better understand customer behaviour and demographic changes.

According to GDS Modellica, “there is currently more customer information available than ever before, even if a new more agile approach is required to use it to make more intelligent decisions (Decisions as a Service). As companies continue to develop cloud-based systems and big data strategies to improve their customer relationships, they will see an increasing need for solutions that offer analytical capabilities, cloud-based apps and a cloud-based development platform for flexible decision management”.

The key to implementing this digital business model is offering the right personalised service at the right price. This means using data analysis to examine each customer’s profitability and offer products or services based on individual, demographic, economic or social profiles. For the foreseeable future, these new digital channels will continue to provide customers with easier ways to manage their finances. As a result, service providers will also need to continue using innovative financial technology to offer new products and services, simplify their internal processes and increase both profitability and efficiency.

Latest Articles

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer

A Comprehensive and Holistic Approach to Digital Banking to Get Closer to the Customer Press

26/05/2021

The customer lifecycle in a digital environment

The customer lifecycle in a digital environment Press ReleaseMadrid, 11th May 2021The digital customer lifecycle

10/05/2021

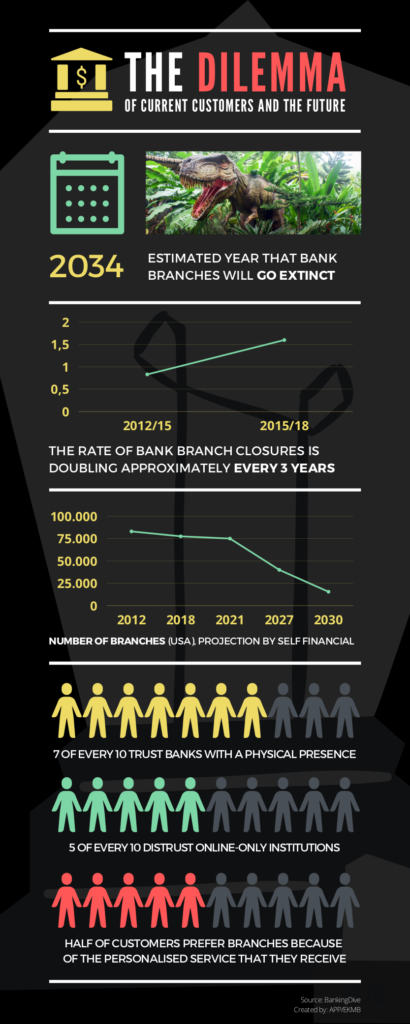

The dilemma for the banking industry: current customers and the future

The dilemma for the banking industry: current customers and the future GDS Modellica The banking

23/04/2021

Request a Demo